Long ago I read a book called “Rich Dad, Poor Dad” by Robert Kiyosaki. I can’t even remember much about the book. However, there was one point that caught my attention that I still think of often. It was about how income flows through different families differently. It was a reflection on how some families prioritize investment and how it made the difference in wealth accumulation or not.

Here is a brief video of me explaining this:

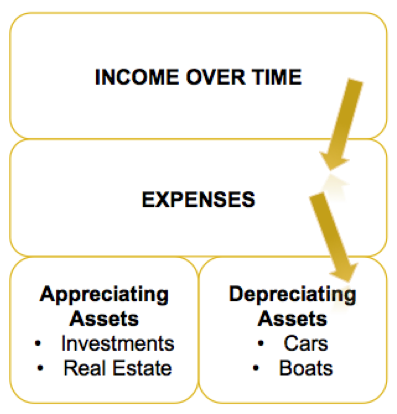

Typical family cash flow diagram

The point was that typically we see families produce income which pays for their expenses and then a lot of the remaining cash flow is spent on assets that often deprecate or lose value over time. In fact, if you think about the assets that we purchase and spend money on do in fact depreciate over time. Examples of these are cars, boats, other vehicles, electronics or technology that can become outdated, etc.

A lot of these items may be required for the type of life that we would like to live, the point is that if you can divert cash flow to assets that appreciate or grow in value over time rather than depreciating assets, that is when wealth building occurs.

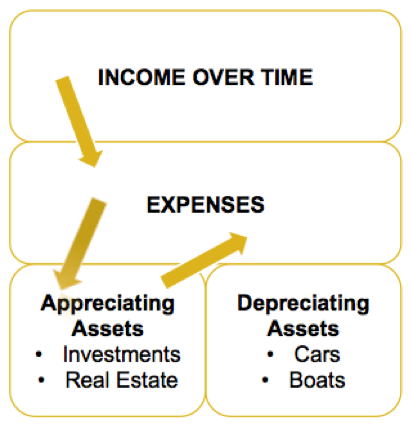

Wealth building cash flow diagram

If we look at the same cash flow diagram but prioritize diverting cash flows to assets that appreciate (rise in value) over time, we can see how perpetually we are putting our money to work for us. Some of the major types of assets that appreciate over time are investments like stocks and bonds, real estate, and typically anything associated with ownership.

Over time we see how this habit of prioritizing investing in appreciable assets can have a snowball effect. As your investments grow they themselves can help contribute cash flows, which in turn help pay for your expenses or help to obtain more appreciable assets. This self-feeding mechanism is how lasting wealth can be created over time. Of course it is not easy, but fundamentally it is easy to see how prioritization of owning appreciable assets can change the course of one’s financial future!